Williamstown's Tax Bill Up, Tax Rate DownBy Stephen Dravis, iBerkshires Staff

04:03AM / Thursday, September 02, 2021 | |

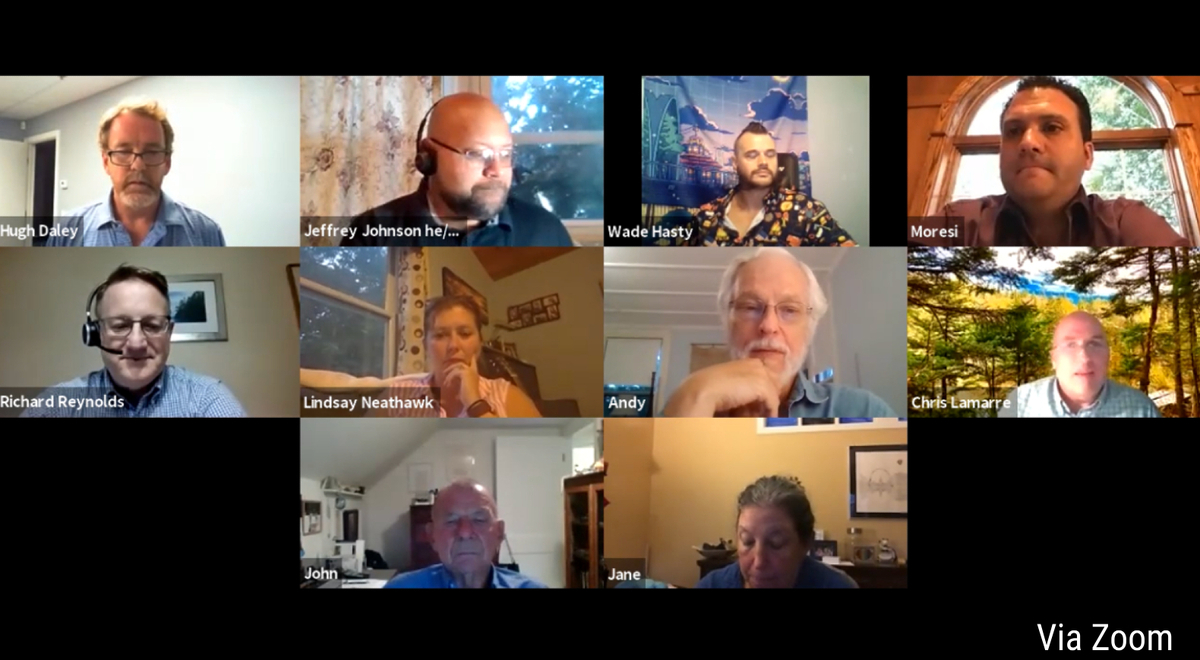

A joint meeting of the Select Board and Prudential Committee voted to keep a single tax rate. A joint meeting of the Select Board and Prudential Committee voted to keep a single tax rate. |

WILLIAMSTOWN, Mass. — For the third straight year, the town's property tax rate is going down, but a typical homeowner can expect to see his or her tax bill increase.

That is because property valuations rose enough in calendar year 2020 to allow the town to raise the increased money it needs for fiscal year 2022 without raising the tax rate, principal assessor Chris Lamarre told elected officials on Monday night.

"The median single family home value for fiscal '22 is determined to be $328,300," Lamarre said. "The median single family tax bill will be $5,555. That's an increase of $272 over last year. Last year, the median single family tax bill was $5,283. The median assessment last year was $305,400."

Lamarre spoke at a joint meeting of the Select Board and the fire district's Prudential Committee, who each needed to decide whether to have a unified tax rate or shift more of the tax burden onto commercial, industrial and personal property, as the commonwealth allows. As they traditionally have done, both bodies chose to go with a single tax rate.

For FY22, that tax rate will be $16.92 per $1,000 of valuation, Lamarre said. That is down from $17.30 per $1,000 last year and $17.60 in FY20.

The tax rate is determined by dividing the levy — the amount needed to be raised through taxation to meet the expenses authorized by town meeting — by the total taxable value of property in town, and multiplying that quotient by 1,000.

In June, voters at town meeting authorized spending of $18.7 million for FY22, up 3.6 percent from the fiscal year that ended on June 30 of this year. That was offset by an increase in the total value of all taxable property (excluding tax-exempt property, like much of Williams College) from $1.04 billion to $1.10 billion, an increase of 6.1 percent.

That is why the rate is able to drop while the tax bill increases: the levy is being assessed on higher-valued property.

Much of the increase in the tax levy derived from an increased assessment from the Mount Greylock Regional School District. Voters approved a $12.3 million bill from the PreK-12 district that represented a 1.9 percent increase from FY21; spending for Williamstown Elementary School and Mount Greylock Regional School, combined, accounts for nearly two-thirds of the $18.7 million levy.

Lamarre discussed the reasons why property values are coming in higher.

"Every five years, the Board [of Assessors] is required to do a deep dive for certification of our values by the [Department of Revenue] and in interim years, it's a much less rigorous process," he said.

"We're all very familiar with how real estate values have been escalating. And I think, in large part, that's due to the low interest rate environment, the influences that the pandemic has had on people, particularly from outside the area, acquiring quite a bit of real estate, and also I have to say there's an acronym known as FOMO, 'fear of missing out.' A lot of folks are jumping into the market, and let's hope that those who are doing it currently don't see negative ramifications years down the road. That's real estate cycles."

While the COVID-19 pandemic appears to have helped drive up residential property values, it may have had the opposite effect on the local commercial real estate market.

The total value of residential real estate in Williamstown rose from $912 million for FY21 to $979 million for the current fiscal year, an increase of 7.3 percent. The valuation for personal property (tangible items that are not firmly attached to land or buildings) went up by $959,000, from $23.8 million to $24.8 million, an increase of 4 percent. But the total value of the town's commercial real estate fell from $94 million to $89 million, a drop of 4.9 percent.

"As we look at the commercial values, we did see a softening in that sector," Lamarre said. "We can attribute that to the pandemic, particularly for those in the hospitality industry, the service industry such as restaurants, retail, office space — they all were hit pretty hard with the lockdowns we had to endure last year."

With the total tax levy rising by 3.6 percent in FY22, the town's excess levy capacity dropped for the first time in several years.

Excess levy capacity is the difference between the maximum amount a municipality can raise through taxation without a Proposition 2 1/2 override and the amount it is actually collecting from taxpayers. Last year, the excess capacity was $2.7 million; in FY22, that number dropped to $2.5 million. It had been steadily climbing over the last four years from just more than $1 million in FY18.

The excess levy capacity for the current fiscal year is about 13 percent of the actual cumulative bill going out to taxpayers. Or, put another way, town meeting voters could have approved — without an override vote — 13 percent more in spending.

Select Board member Hugh Daley noted that had the town spent up to its levy capacity, the property tax rate would have been $2.25 higher per $1,000 of valuation.

|