Critics of Residential Tax Exemption in Williamstown State Their CaseBy Stephen Dravis, iBerkshires Staff

05:45AM / Wednesday, August 16, 2023 | |

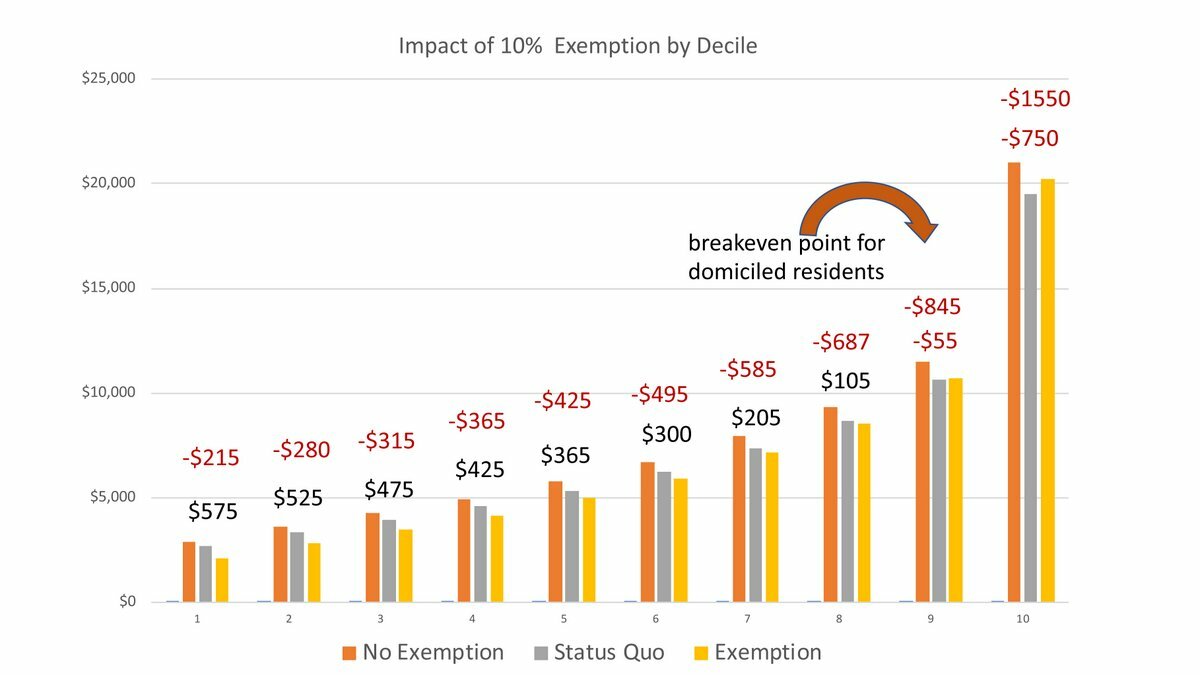

In this chart prepared by Stephanie Boyd, the Y axis has property tax bills; the X axis has the town's single-family homes in 10 groups by value. The bars show the tax bill with no change (gray), with homes eligible for an exemption (yellow), and with homes that are ineligible (red). In this chart prepared by Stephanie Boyd, the Y axis has property tax bills; the X axis has the town's single-family homes in 10 groups by value. The bars show the tax bill with no change (gray), with homes eligible for an exemption (yellow), and with homes that are ineligible (red). |

WILLIAMSTOWN, Mass. — Two former members of the Select Board on Monday urged current members of the panel to reject calls to implement a residential property tax exemption.

Jeffrey Thomas spoke for seven minutes from the floor of the meeting, imploring the board to "move on" and not waste time even considering whether an RTE could benefit members of the community.

"This idea solves a problem that doesn't exist," Thomas said. "Ostensibly, it's about affordable housing, but it absolutely will have no impact on affordable housing here. … I can't even believe you guys are discussing it, quite honestly.

"I would very much like for you guys to thumbs down this thing right now. Please, do not set up an ad hoc committee to study it. Please do not pay some consultant $50,000 or $100,000 to study this. It's been studied in other communities. There's lots of data that's available. Please, let's just move on. It's just not a good idea for our community."

"It" is a mechanism in Massachusetts General Law that allows municipalities to shift some of the property tax burden away from full-year residents and toward second-home owners. Select Board member Stephanie Boyd's analysis shows that in communities like Williamstown, the RTE also would shift the tax burden away from homes with lower property values toward residences valued at $655,723 and above — with the greatest impact for homes valued at $810,000 and up.

Boyd has argued repeatedly that implementing the RTE would make Williamstown's main source of municipal revenue, property taxes, less regressive. She cites data that shows lower-income homeowners pay a higher percentage of their income toward property taxes than do higher-income homeowners in more expensive homes.

"No, it is not means tested," Boyd said, referring to one of the criticisms of the RTE. "Our current property tax is also not means tested. … But there is all kinds of evidence that shows that wealthier people pay a lower percentage of their income on taxes than less wealthy people. So, on average, that's what happens out there."

Later in the evening she added, "I know people have said this is a blunt instrument. Property tax in itself is a blunt instrument. This gives us an opportunity to fine tune it a little bit."

Thomas told the board that the current taxing regime does not need fine-tuning. As evidence, he cited data from the town's treasurer/collector's office indicating that the town's annual tax collection rate is 99 percent.

"There is no evidence that people in Williamstown are struggling to pay their property taxes," Thomas said. "There's not a problem here that I see that needs to be solved."

Thomas went on to argue that implementing the RTE in Williamstown would disadvantage homeowners like himself.

"Let's just consider someone who, a little bit like me, bought their home as firmly a middle-class person — middle income, paying our mortgage, maybe we do some renovations, maybe we add a room or two because our family has expanded or we want to redo a bathroom or a kitchen or what have you," Thomas said. "Over the years, our properties appreciate, right? I know a friend of mine bought their home in 1981 for $70,000. It was a two-family; they rented out half of it to pay the mortgage. That home is now worth 10 times what they paid for it.

"Good for them. Good for them. That's the American dream, right? And they want to age in place, just like I do. But you're now going to shift the tax burden on them and me and a lot of people in our situation who have done the right things, who have tried to live our version of the American dream, and our houses happened to appreciate. Good for us!"

Thomas also shared with the board a two-page analysis of the residential tax exemption by Town Assessor Chris Lamarre. In it, Lamarre argues that the RTE "contradicts the assessing principle that 'all property owners pay their fair share, no more-no less.'"

Lamarre also cites the town's low property tax delinquency rate as evidence that residents do not now have trouble paying their tax bill.

The town's assessor also argued that the RTE will create political problems for future town officials.

"Residential Exemption greatly distorts the cost of delivering government services — those receiving an exemption become desensitized to budget increases and are lulled into 'budget complacency,' while those paying more become increasingly vigilant and less likely to embrace future increases, regardless of need," Lamarre wrote in his two-page memo responding to a request from Thomas.

Former Select Board member Hugh Daley followed Thomas at the podium on Monday and offered a different argument against the RTE, arguing that people choose to own homes in Williamstown in spite of its high property taxes.

"Property tax is one of the few taxes you can choose," Daley said. "If you don't like the tax rate or the expense of the tax rate, you can choose to not buy here. If you feel the value you receive is less than the tax you pay, you can vote on the budget. You can vote to lower the taxes, or even move. Everyone who pays property taxes purchased their property knowing what the rules of the game are.

"If property tax is a burden, it's a burden people choose to bear. There are lots of bills I don't like paying, but that doesn't mean the town should subsidize them. That's what this would do."

Boyd, whose July 24 presentation explored the background of why the town might want to make the property tax system more progressive, focused her Monday presentation on potential impacts of the RTE if Williamstown followed suit with 19 other communities — most recently Concord — in adopting the exemption.

Because the RTE would allow primary residence owners in Williamstown to exempt up to 35 percent of their property value (Boyd chose 10 percent as a starting point for her analysis), but still would need to raise the same amount of money in taxes, the RTE would mean an immediate spike in the property tax rate in town.

But that spike would impact homeowners differently depending on the value of their home.

Most of the town's full-year single-family residences would see a decrease in their property tax bill once the RTE is implemented, according to Boyd's analysis.

Homes assessed above the "break even" point of $655,723 would see their annual property tax bills go up. Houses assessed below that number would get a tax break.

Some analysis Boyd added since her July presentation looked at how the RTE would impact homeowners in each decile of property value in the town. She broke the town's residences into 10 groups with average home values ranging from $176,818 in the first decile to $1.3 million in the 10th decile.

Homes used as a primary residence in the first decile (values ranging from $80,800 to $202,300) would realize a $575 savings per year in property taxes if the RTE was set at 10 percent. At the other end of the spectrum, homes used as a primary residence in the 10th decile ($810,800 to $4.7 million) would pay $750 per year more after the RTE.

Only residents in the ninth and 10th deciles would see a property tax bill increase for homes eligible for the residential tax exemption.

Homes not eligible for the exemption — second homes or rental properties — would see a tax increase in every decile. Likewise, unless Williamstown breaks with tradition and begins setting a separate commercial property tax rate, all commercial properties would see an increase in their property tax bill.

The commercial class would be unaffected, Boyd said on Wednesday. The town would first set the tax rate based on the total tax base. Then, the residential exemption calculations would be done for the residential class. That would, in effect, yield a separate residential rate that would be higher than the commercial tax rate.

Some on the Select Board have expressed concern that the RTE would penalize owners of rental properties, who would pass the penalty along in the form of increased rents, thus potentially making apartment and home rental less affordable.

Boyd on Monday answered those criticisms by saying the town could employ the "expanded residential tax exemption" utilized by communities like Provincetown. There, a property owner can claim an exemption for a home occupied by a full-time resident (renter), even if the owner does not live in town.

"Thus, in addition to progressively shifting taxes among residents who own their own home, the policy encourages property owners — especially of low and medium value properties — to charge lower rents, which is also progressive," according to a report from the Massachusetts Budget and Policy Center.

Boyd cut her presentation short when her colleagues on the board reported hearing from constituents that they were having trouble following the accompanying 25-page PowerPoint presentation either online or on the town's community access television station. But she said she will continue to talk about the issue and push the board to study it further, even if not all her colleagues expressed an appetite for adopting the RTE as soon as September's tax classification hearing for fiscal 2024.

Andrew Hogeland for one has repeatedly expressed reluctance to use the RTE because it is not means tested. On Monday, he pitched an alternative, more targeted way to provide property tax relief to those who need it.

"I'd like to help people who are in need when it comes to paying their property taxes, but this program is not based on anything like need," Hogeland said. "It's got presumptions about house values and incomes; there's no information about incomes or whatever other assets people have."

On Tuesday morning, Town Manager Robert Menicocci confirmed that the town has no access to state Department of Revenue or IRS numbers about specific residents' income and no way to definitively tie income to specific property values.

"Unless there's a needs-based approach to a needs-based problem, I don't see that this is anything near what we're looking for," Hogeland said. "I think by giving tax breaks to 50 or 60 or 80 percent of the town, you're giving tax breaks to people who clearly do not need it. And because of house poor people, you're not giving it to people who actually do need it.

"I think there's an alternative here of putting together a proposal that actually would develop a needs-based approach toward property tax exemptions. It would be an expansion of what we did at town meeting, where we lowered the age and increased the amounts [of an existing exemption program for seniors]. What we would do, in my view, is get rid of the age requirement altogether or lower it substantially. We could increase the amounts of the income and assets allowances that are allowed by state law. This would be in the form of a home-rule petition."

Hogeland said he approached state Rep. John Barrett III, D-North Adams, about whether it would make sense to introduce legislation allowing every town to enact such age and income parameters. But Barrett advised that a home rule petition made more sense.

"I think Stephanie [Boyd's] list of options is missing that one," Hogeland said. "I think that's the one which would be really focused on addressing the need we'd like to address without having all these unpleasant and unnecessary consequences."

Boyd indicated that she would not oppose Hogeland bringing forward such a proposal but continued to argue that the residential tax exemption would be one way to make the town's taxation policy less regressive than it is.

"I find it sad that we think our definition of 'need' is someone paid their bill late or didn't pay their bill or whatever, when in fact there are decisions made in all kinds of families in this town that are not going to eat something for dinner, their kid's not going to go to camp or something is not going to happen so they can pay their property bill, and you're never going to know about it," Boyd said. "People come up to me and quietly say, 'Thank you, Stephanie, for speaking up.' I think we just have to be really, really careful about how we talk about our community and how we casually talk about their needs.

"It's not the fact that a lot of people are going to save money that's important. What's important is that those people at the low end, who are struggling, are going to get a little bit of a break. And it's not going to impact, seriously, other people. … [Research] is telling us that low-income people are subsidizing the wealthy. That's what we're talking about. It's not whether someone can scratch together enough dollars to pay their tax bill.

"What we're talking about here tonight is whether those of us with a lot of stuff can share a little bit of it with our community. And if we can't do that, we should at least spend a lot of time thinking about why we're saying no and why we're putting up so much resistance to even understand what we're talking about."

This story was updated on Wednesday afternoon to clarify the impact of the RTE on commercial property taxes.

|